The BP (LSE:BP.) share price this decade has been anything but stable. It’s actually nearly 35% below its all-time high right now.

Yet, in recent years, the shares have shot up almost 125%. That’s since October 2020, but I’m not sure the momentum will last.

With oil being clamped down on and renewable energy on the rise, can BP really continue to grow like it has done over the last few decades?

Operations I’m considering

The company’s current motto, as pulled from its 2022 annual report, is ‘performing while transforming’.

To me, this speaks to the necessary changes needed for BP to remain relevant in a future renewable energy economy. Yet, we’re some way off from that. So, what are BP’s plans?

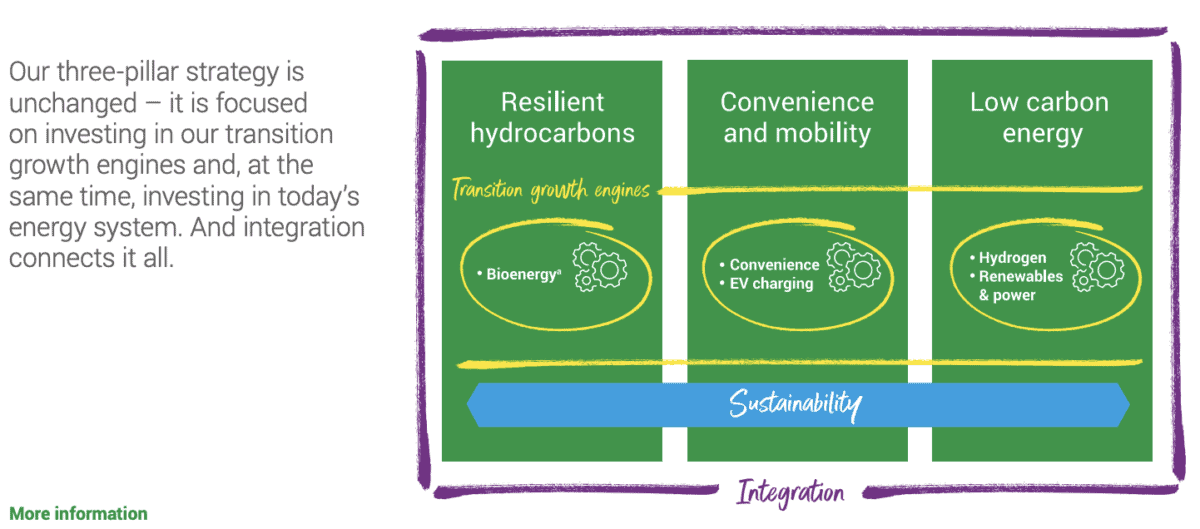

Well, the company has a sustainability integration plan:

And while I think this is nice to consider, realistically the company is still quite dependent on traditional oil products.

BP is actually focused on increasing its oil and gas revenues by 2025 and maintaining these until 2030.

This does make sense. The global economy, as it has stated in BP’s annual report, is still not on track to meet eco-friendly targets.

Why I’m not a shareholder

To me, the company’s revenue instabilities are a concern. For example, in 2017, revenues were £180bn, then down to £79bn in 2020, then up to £198bn in 2022.

These revenue fluctuations are very clear in the price chart, where the share price has moved around with near-equal instability.

But I don’t invest like the general public seems to be on short-term revenue estimates and reports. Instead, I look more toward future company plans for my investment decisions.

While BP is really trying to enter the bioenergy, electric vehicle (EV) charging, hydrogen and renewable markets, it has steep competition in these areas, including from Tesla, ADM and TotalEnergies.

Tesla dominates EV charging, ADM is a leader in bioenergy, including ethanol and biodiesel, and TotalEnergies is a leading competitor for BP in renewables.

I’m not convinced the company will remain a top dog like in the last century’s oil boom when its share price rose around 400% from 1988 to 2000.

The company is also carrying a lot of debt on the balance sheet. Its total liabilities rested at over 70% of total assets in 2022.

My big concern

My largest doubt is whether the share price can increase beyond where it is right now.

Because of the difficulties the company may face with the renewable energy transition, I think we could have a period of revenue and share price losses coming.

For that reason, the shares are not in my portfolio.

I’ll be watching carefully, though, to see if BP can really become ‘Beyond Petroleum’, as it has been touting itself recently.